Investing is an essential part of building wealth and securing financial stability for the future. High yield investments are a popular choice for investors looking to increase their returns beyond traditional options. However, high returns come with increased risk, and investors must have a clear understanding of the investment options available and their associated risks. In this comprehensive guide, we will explore high yield investments, the risks and benefits, and the strategies for maximizing returns.

Table of Contents

- Introduction

- What are High Yield Investments?

- Types of High Yield Investments

- Bonds

- Dividend Stocks

- Real Estate Investment Trusts (REITs)

- Peer-to-Peer Lending

- Options Trading

- Cryptocurrencies

- Foreign Exchange (Forex) Trading

- Commodities Trading

- Hedge Funds

- Private Equity

- Risks Associated with High Yield Investments

- Credit Risk

- Market Risk

- Interest Rate Risk

- Inflation Risk

- Liquidity Risk

- Currency Risk

- Operational Risk

- Benefits of High Yield Investments

- High Returns

- Diversification

- Income Generation

- Strategies for Maximizing Returns with High Yield Investments

- Conduct thorough research

- Diversify your portfolio

- Set realistic goals

- Practice risk management

- Monitor your investments regularly

- Conclusion

- FAQs

What are High Yield Investments?

High yield investments, also known as «junk bonds,» are investments that offer higher returns than traditional options such as stocks, bonds, and mutual funds. These investments carry higher risk due to the nature of the issuer or investment vehicle, making them more susceptible to default or bankruptcy.

High yield investments are generally issued by companies with a lower credit rating or that are undergoing financial difficulties. Due to their higher risk, they offer higher yields to investors who are willing to take on that risk. These investments are ideal for investors who are seeking to maximize their returns and are comfortable with taking on more risk in their investment portfolio.

Types of High Yield Investments

There are various types of high yield investments, each with its own unique characteristics and risk profile. Here are some of the most common high yield investment options:

Bonds

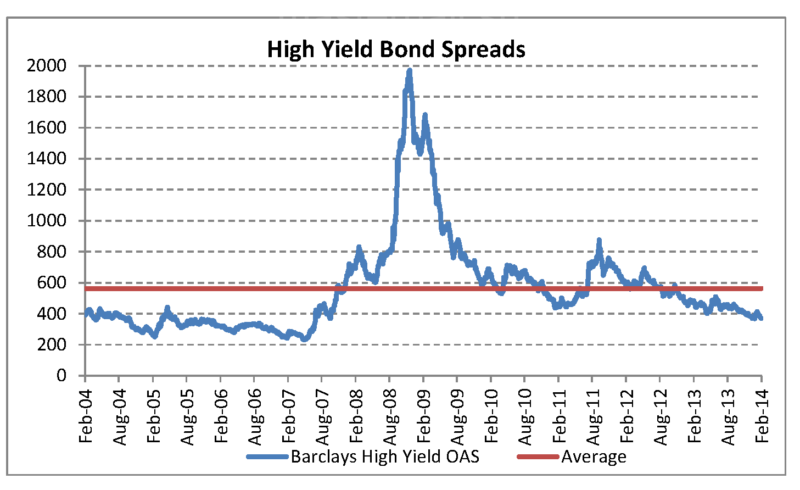

High yield bonds, also known as «junk bonds,» are issued by companies with lower credit ratings, making them more susceptible to default. These bonds offer higher yields than investment-grade bonds to compensate for the increased risk.

Dividend Stocks

Dividend stocks are stocks that pay out a portion of their profits to shareholders as dividends. High dividend stocks offer higher yields than traditional stocks, but they also carry a higher risk.

Real Estate Investment Trusts (REITs)

REITs are companies that own and manage income-generating real estate properties such as office buildings, shopping malls, and apartment complexes. They offer high yields to investors in the form of dividends and capital appreciation.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending is a type of lending where investors lend money to borrowers through an online platform. P2P lending offers high yields to investors, but it also carries a higher risk of default.

Options Trading

Options trading is a type of trading where investors buy and sell options contracts on underlying assets such as stocks, bonds, and commodities. Options trading can offer high returns, but it also carries a high level of risk.

Cryptocurrencies

Cryptocurrencies such as Bitcoin and Ethereum have gained popularity in recent years due to their high returns. However, they are also highly volatile and carry a significant risk.

Foreign Exchange (Forex) Trading

Forex trading involves buying and selling currencies in the foreign exchange market. It can offer high returns, but it also carries a high level of risk due to the volatility of the currency markets.

Commodities Trading

Commodities trading involves buying and selling commodities such as gold, oil, and agricultural products. It can offer high returns, but it also carries a high level of risk due to the volatility of commodity prices.

Hedge Funds

Hedge funds are private investment funds that use advanced investment strategies to generate high returns. They typically have high minimum investment requirements and are only available to accredited investors.

Private Equity

Private equity involves investing in privately held companies that are not listed on public stock exchanges. Private equity investments can offer high returns, but they are illiquid and require a long-term investment horizon.

Risks Associated with High Yield Investments

High yield investments carry higher risks than traditional investments, and investors must have a clear understanding of these risks before investing. Some of the most common risks associated with high yield investments include:

Credit Risk

High yield investments are issued by companies with lower credit ratings, making them more susceptible to default. If the issuer defaults on its payment obligations, investors may lose some or all of their investment.

Market Risk

High yield investments are often more volatile than traditional investments, making them more susceptible to market fluctuations. Investors may experience significant losses if the market turns against them.

Interest Rate Risk

High yield investments are often sensitive to changes in interest rates. If interest rates rise, the value of the investment may decline, resulting in a loss for the investor.

Inflation Risk

Inflation can erode the purchasing power of an investor’s returns. If the rate of inflation exceeds the return on the investment, the investor may experience a loss in real terms.

Liquidity Risk

Some high yield investments are illiquid, meaning they cannot be easily sold or converted to cash. If an investor needs to access their funds quickly, they may not be able to do so.

Currency Risk

Investments denominated in foreign currencies carry currency risk. Fluctuations in exchange rates can affect the value of the investment, resulting in gains or losses for the investor.

Operational Risk

Some high yield investments involve complex financial instruments or investment strategies, which can result in operational risk. If the investment manager or issuer fails to execute the strategy properly, investors may experience losses.

Benefits of High Yield Investments

Despite the increased risks, high yield investments offer several benefits to investors. These include:

High Returns

High yield investments offer the potential for higher returns than traditional investments. This can help investors achieve their financial goals more quickly.

Diversification

Investing in high yield investments can help diversify an investor’s portfolio, reducing their overall risk.

Income Generation

Some high yield investments, such as dividend stocks and REITs, offer regular income to investors in the form of dividends or rental income.

Strategies for Maximizing Returns with High Yield Investments

Investors can maximize their returns with high yield investments by following these strategies:

Conduct thorough research

Investors should conduct thorough research on any high yield investment they are considering. This includes researching the issuer or investment vehicle, its track record, and its financial performance.

Diversify your portfolio

Investors should diversify their portfolio by investing in a variety of high yield investments. This can help reduce the overall risk of their portfolio.

Set realistic goals

Investors should set realistic goals for their high yield investments, taking into account their risk tolerance and investment horizon.

Practice risk management

Investors should practice risk management by setting stop-loss orders and monitoring their investments regularly.

Monitor your investments regularly

Investors should monitor their high yield investments regularly to ensure that they are performing as expected. This can help investors identify potential issues early on and take action to mitigate their risk.

Conclusion

High yield investments can be an attractive option for investors seeking higher returns than traditional investments. However, these investments come with increased risks, and investors must have a clear understanding of these risks before investing. By following the strategies outlined in this guide, investors can maximize their returns while minimizing their risk.

FAQs

- What is a high yield investment?

A high yield investment is an investment that offers higher returns than traditional investments such as stocks, bonds, and mutual funds. These investments carry increased risk due to the nature of the issuer or investment vehicle.

- What are the risks associated with high yield investments?

The risks associated with high yield investments include credit risk, market risk, interest rate risk, inflation risk, liquidity risk, currency risk, and operational risk.

- What are the benefits of high yield investments?

The benefits of high yield investments include high returns, diversification, and income generation.

- How can investors maximize their returns with high yield investments?

Investors can maximize their returns with high yield investments by conducting thorough research, diversifying their portfolio, setting realistic goals, practicing risk management, and monitoring their investments regularly.

- Is investing in high yield investments suitable for all investors?

No, investing in high yield investments is not suitable for all investors. These investments carry increased risk and are only suitable for investors who are comfortable with taking on that risk. It is important to consult with a financial advisor before investing in high yield investments.